JohnEngelman

Virgin

- Joined

- Jan 8, 2022

- Posts

- 3,616

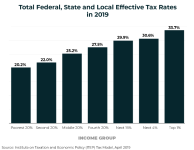

TastySuckToy is trying to explain why policies he does not like will not work.A moment ago, you argued that the rich don’t pay taxes so raising taxes on them is irrelevant.

Now, faced with facts, you say the rich do pay taxes and are in fact paying too much!

Twisting yourself in knots like that is going to hurt your back.

The truth is: the rich do pay taxes and raising the top marginal tax rate does increase revenue.