Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The Economy

- Thread starter MajorRewrite

- Start date

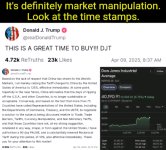

Your buddy Rot Down South said it was fake news came n shorted VOL

BTW I bought when the tweet came

Well he has more money now than God so and that's the ONLY reason his is where he is today! He can't and won't be bought like the establishment who sold us out that he's making EXTICT! FOREVER!

DeluxAuto

AntiSocial Extrovert

- Joined

- Dec 16, 2010

- Posts

- 24,140

Media Staging Coup To Crash Stock Market to Undermine Trump

Posted Apr 9, 2025 by Martin Armstrong

COMMENT: The media including the financial media really going crazy with this Trump Tariff thing – as if the market wasn’t due for a pull back.

REPLY: We had forecast that we would see a correction by April last year. I answered plenty of questions on various podcasts about whether this would be a big crash and the end of the bull market. I consistently warned that such a scenario was absurd, for that implied the classic flight to quality being government debt. Facing a global sovereign debt crisis, I warned that it was just not realistic. The press has latched onto this normal correction and is deliberately trying to crash the market with constant claims that tariffs will destroy the world economy.

This is the very same political scheme they used in 1932 to blame tariffs on Hoover and the Republicans to win the 1932 election. It was a total lie and a fabrication of history. We are witnessing the attempted coup of Trump by deliberately trying to force the stock market down in a desperate attempt to turn the Republicans against Trump and stop his entire agenda of ending the Democrats’ feeding trough for corruption. I was stunned by the conversation I had yesterday and a deliberate media attempted coup.

Tariffs do not cause a DEPRESSION, no matter how much the media is selling that story now, just as the Democrats did in 1932 to get FDR elected. They also failed to protect any country from the effects of the worldwide depression at the time.

Between 1925 and 1929, there were 33 general revisions or substantial tariff changes, nearly all of which raised tariffs. These included 26 European nations and 17 republics of Latin America. In 1927 and 1928, Australia, Canada, and New Zealand increased and expanded the scope of their tariffs. In Asia, China, Persia, and Siam also raised tariffs during the period.

This was all before the 1929 Crash, which the history books omitted along with the 1931 Sovereign Defaults.

More here: https://www.armstrongeconomics.com/...oup-to-crash-stock-market-to-undermine-trump/

You're going to have a lot of apologizing to do, Jack.

Market has to crash for a GLBAL FINANCIAL RESET and getting rid of the FIliat takes out the all the evil rich ones!Gold backed is coming!The media didn't cause the stock market drop, you fucking idiot.

The stock market expected a rational tariffs policy and Trump didn't provide it.

ll74

Your Best Friend

- Joined

- Aug 22, 2013

- Posts

- 68,632

Lol.....yes.....the gold backed dollarMarket has to crash for a GLBAL FINANCIAL RESET and getting rid of the FIliat takes out the all the evil rich ones!Gold backed is coming!

DeluxAuto

AntiSocial Extrovert

- Joined

- Dec 16, 2010

- Posts

- 24,140

Media Staging Coup To Crash Stock Market to Undermine Trump

Posted Apr 9, 2025 by Martin Armstrong

COMMENT: The media including the financial media really going crazy with this Trump Tariff thing – as if the market wasn’t due for a pull back.

REPLY: We had forecast that we would see a correction by April last year. I answered plenty of questions on various podcasts about whether this would be a big crash and the end of the bull market. I consistently warned that such a scenario was absurd, for that implied the classic flight to quality being government debt. Facing a global sovereign debt crisis, I warned that it was just not realistic. The press has latched onto this normal correction and is deliberately trying to crash the market with constant claims that tariffs will destroy the world economy.

This is the very same political scheme they used in 1932 to blame tariffs on Hoover and the Republicans to win the 1932 election. It was a total lie and a fabrication of history. We are witnessing the attempted coup of Trump by deliberately trying to force the stock market down in a desperate attempt to turn the Republicans against Trump and stop his entire agenda of ending the Democrats’ feeding trough for corruption. I was stunned by the conversation I had yesterday and a deliberate media attempted coup.

Tariffs do not cause a DEPRESSION, no matter how much the media is selling that story now, just as the Democrats did in 1932 to get FDR elected. They also failed to protect any country from the effects of the worldwide depression at the time.

Between 1925 and 1929, there were 33 general revisions or substantial tariff changes, nearly all of which raised tariffs. These included 26 European nations and 17 republics of Latin America. In 1927 and 1928, Australia, Canada, and New Zealand increased and expanded the scope of their tariffs. In Asia, China, Persia, and Siam also raised tariffs during the period.

This was all before the 1929 Crash, which the history books omitted along with the 1931 Sovereign Defaults.

More here: https://www.armstrongeconomics.com/...oup-to-crash-stock-market-to-undermine-trump/

Fact check: Trump's false claims about tariffs

Alima de Graaf

04/04/2025April 4, 2025

President Donald Trump imposed new tariffs — and made false claims to justify them. DW fact-checked two viral ones.

https://p.dw.com/p/4sg8L

US President Trump announces "reciprocal" tariffs in a press conference at the White House and shows a chart of the tariffs imposed by other countries on the US, and what the US will impose in return.

US President Trump announced "reciprocal" tariffs in a press conference at the White House.

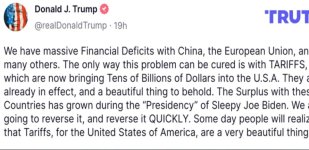

In a press conference in the Rose Garden of the White House on April 2, US President Donald Trump announced a new round of global tariffs. His statements on the tariffs' calculations, justifications and effects, however, were filled with false claims. And they put many economies in a bind. Some countries have already announced countermeasures.

DW fact-checked two viral claims by Trump.

Claim: In a video, attached in this post on X, with 1.1 million views at the time of writing, Trump states that "Canada by the way imposes a 250-300% tariff on many of our dairy products, the first can of milk, the first little carton of milk, very low price, after that, it gets bad."

DW Fact check: False

The tariffs Canada imposes on US dairy products are arranged in the United States-Mexico-Canada Agreement (USMCA). It applies to 14 categories of dairy products, such as milk, butter, cheese, yogurt, and ice cream.

As agreed in the USMCA, a certain number of US dairy products is allowed to enter the Canadian market tariff-free. When this limit is reached, other tariff calculations kick in to protect domestic producers. These over-quota tariffs are between 200 and 300%. However, according to the USMCA, Canada has guaranteed that tens of thousands of metric tons of imported US milk per year will face zero tariffs.

Screenshot of a video on X showing Trump and his false claim about Canadian tariffs on US dairy productsScreenshot of a video on X showing Trump and his false claim about Canadian tariffs on US dairy products

In a video on X, Trump made false claims about Canadian tariffs on US dairy productsImage: X

How likely is it that the US must pay these high over-quota tariffs?

US-based news outlet Bloomberg wrote that in practice 99,9% of US dairy products enter Canada tariff-free. The over-quota rates for US imports to Canada are not close to being reached in many of the categories — including milk.

Even the senior vice president of trade and workforce policy at the International Dairy Food Association (IDFA), stated that the US has "never gotten close to exceeding our USMCA quotas."

Though these high over-quota tariffs are unlikely to be implemented, it is typical for over-quota tariffs to be high in general. The US itself also has a similar system of high over-quota tariffs on importing dairy products.

In the speech, Trump also repeated his frequent false claim that, because of the tariffs he imposed on China during his first term, the US "took in hundreds of billions of dollars." While foreign companies may feel the impact of tariffs indirectly, through reduced sales or the need to lower prices to remain competitive, the actual payment of the tariff is made by the importing businesses, which could be American, as DW Fact check explained in a previous article.

But these weren't the only false claims US President Trump made about tariffs and trade.

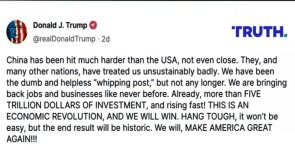

Claim: In this post on his own social media platform Truth Social, Trump shared the same chart he had shown at the press conference at the White House when he announced the "reciprocal" global tariffs. According to Trump, the chart shows a breakdown of the tariffs other countries charge the US and the corresponding tariff that the US will now impose against those countries. He claimed the European Union, shown at the second position, charges 39% tariffs on imports from the US.

DW Fact check: False

But now it's not crashing because Orange Julius Caesar just changed his mind again . . .Market has to crash for a GLBAL FINANCIAL RESET and getting rid of the FIliat takes out the all the evil rich ones!Gold backed is coming!

Rightguide

Prof Triggernometry

- Joined

- Feb 7, 2017

- Posts

- 70,709

Updated Wed, Apr 9 20255:09 PM EDT

ShareShare Article via FacebookShare Article via TwitterShare Article via LinkedInShare Article via Email

Hakyung Kim

https://www.cnbc.com/2025/04/08/stock-market-today-live-updates-.html

Where's PrivateRewrite?

ShareShare Article via FacebookShare Article via TwitterShare Article via LinkedInShare Article via Email

Dow surges 2,900 points, S&P 500 posts biggest gain since 2008 on Trump tariff reversal: Live updates

John MelloyHakyung Kim

https://www.cnbc.com/2025/04/08/stock-market-today-live-updates-.html

Where's PrivateRewrite?

ll74

Your Best Friend

- Joined

- Aug 22, 2013

- Posts

- 68,632

You need at least a month of that to recover from the YTD lossesUpdated Wed, Apr 9 20255:09 PM EDT

ShareShare Article via FacebookShare Article via TwitterShare Article via LinkedInShare Article via Email

Dow surges 2,900 points, S&P 500 posts biggest gain since 2008 on Trump tariff reversal: Live updates

John Melloy

Hakyung Kim

https://www.cnbc.com/2025/04/08/stock-market-today-live-updates-.html

Where's PrivateRewrite?

But now it's not crashing because Orange Julius Caesar just changed his mind again . . .

King IDJIT will be back with a LoGiCaL "explanation" - once Q has reprogrammed the tiny chip in King IDJIT’s head…

MajorRewrite

Iffy

- Joined

- Mar 14, 2014

- Posts

- 9,256

Updated Wed, Apr 9 20255:09 PM EDT

ShareShare Article via FacebookShare Article via TwitterShare Article via LinkedInShare Article via Email

Dow surges 2,900 points, S&P 500 posts biggest gain since 2008 on Trump tariff reversal: Live updates

John Melloy

Hakyung Kim

https://www.cnbc.com/2025/04/08/stock-market-today-live-updates-.html

Where's PrivateRewrite?

As I replied in the other thread, you are remarkably economically illiterate.

Trump reversed his dumb tariffs that were crashing the markets.

He broke it, and when he stopped actively breaking it the markets went up. He can’t claim a win for pausing the damage he was doing.

I really didn’t think any of you MAGA sheep would be dumb enough to make that argument, but you surpassed my expectation of how dumb you are!

MajorRewrite

Iffy

- Joined

- Mar 14, 2014

- Posts

- 9,256

^^^Simpleton Colored CUNTTHUG

Comrade RightGuide may be a simpleton, but there’s no reason to call him a “colored cunt thug”.

DeluxAuto

AntiSocial Extrovert

- Joined

- Dec 16, 2010

- Posts

- 24,140

You stupid dumbass.Updated Wed, Apr 9 20255:09 PM EDT

ShareShare Article via FacebookShare Article via TwitterShare Article via LinkedInShare Article via Email

Dow surges 2,900 points, S&P 500 posts biggest gain since 2008 on Trump tariff reversal: Live updates

John Melloy

Hakyung Kim

https://www.cnbc.com/2025/04/08/stock-market-today-live-updates-.html

Where's PrivateRewrite?

DeluxAuto

AntiSocial Extrovert

- Joined

- Dec 16, 2010

- Posts

- 24,140

What was your favorite "buy?"Glad I was buying and not selling.

Chumps.

LOL OK! This has only been in the planning since 911, I'm sure the Orange monster suddenly changed his mind! But I can tell you he's watching every move to expose even more criminal activity! He's got a knack for pulling criminals out of the wood work, just like he did with this guy ! The ones who scream the loudest...But now it's not crashing because Orange Julius Caesar just changed his mind again . . .

RobDownSouth

General Disaster

- Joined

- Apr 13, 2002

- Posts

- 79,092

Ishmael's post is oddly reminiscent of AJ's continual crowing that he "got in on the ground floor" on days when the stock market had a great day...he was the ultimate "market timer".What was your favorite "buy?"

ll74

Your Best Friend

- Joined

- Aug 22, 2013

- Posts

- 68,632

Every single country was ready before 47 did anything.

We had perfectly good agreements in place that allowed free trade to flourish.

And just like the USMCA, whatever new agreements come from this, will be the same thing with a new label.

Funny enough, it's likely that the TPP that Obama negotiated will be resurrected and used with Asian countries......the same one that 45 tore up when he assumed office.

We had perfectly good agreements in place that allowed free trade to flourish.

And just like the USMCA, whatever new agreements come from this, will be the same thing with a new label.

Funny enough, it's likely that the TPP that Obama negotiated will be resurrected and used with Asian countries......the same one that 45 tore up when he assumed office.

RobDownSouth

General Disaster

- Joined

- Apr 13, 2002

- Posts

- 79,092

Orange Julius Caesar's foreign policies are largely performative anyway!Every single country was ready before 47 did anything.

We had perfectly good agreements in place that allowed free trade to flourish.

And just like the USMCA, whatever new agreements come from this, will be the same thing with a new label.

Funny enough, it's likely that the TPP that Obama negotiated will be resurrected and used with Asian countries......the same one that 45 tore up when he assumed office.

DeluxAuto

AntiSocial Extrovert

- Joined

- Dec 16, 2010

- Posts

- 24,140

ChodeBum was asked last week about what stocks he was eyeballing. He failed to answer then, too. I guess lying to support a fucking idiot is his way of admitting defeat.Ishmael's post is oddly reminiscent of AJ's continual crowing that he "got in on the ground floor" on days when the stock market had a great day...he was the ultimate "market timer".

RobDownSouth

General Disaster

- Joined

- Apr 13, 2002

- Posts

- 79,092

As the smoke clears from teh Great Tariff Debacle ashes, it becomes increasingly clear that it was the BOND market that drove Trump to abandon his risky Tariff plan. Tariffmeister Peter Navarro is now officially the odd man out.

When stock and equity markets collapse, until last week the smart money on Wall Street always goes into the "safety" of the bond market, specifically 5 year and 30 year Treasury bonds. The increased demand for bonds (as a result of stocks being sold) lowers the interest rate on Treasury bonds, which 95% of the time means homeowners pay lower rates on mortgages, which boosts housing and real estate markets.

And if Trump knows one thing, it's real estate.

But something very strange happened this week. Investors abandoned the stock market, as expected....but they also ABANDONED THE US BOND MARKET. The sell-off in Treasury bonds yesterday foreshadowed a potential disaster of BIBLICAL PROPORTIONS in America: bond yield rose briefly above 5%, which basically meant the Republicans were looking at home mortgage rates potentially at 7 to 7.5% by the midterm elections, which very likely would have resulted in a rout of Republicans in the midterms.

Uh comma space oh!

Investor capital has now moved offshore to Japan and Hong Kong and who knows where else, but it's no longer within the "safe" confines of the United States.

It's almost as if the market decided, individually or together, that the full "faith 'n credit" of the United States of America was no longer guaranteed with a chaotic White House policy dictated by tweets.

When stock and equity markets collapse, until last week the smart money on Wall Street always goes into the "safety" of the bond market, specifically 5 year and 30 year Treasury bonds. The increased demand for bonds (as a result of stocks being sold) lowers the interest rate on Treasury bonds, which 95% of the time means homeowners pay lower rates on mortgages, which boosts housing and real estate markets.

And if Trump knows one thing, it's real estate.

But something very strange happened this week. Investors abandoned the stock market, as expected....but they also ABANDONED THE US BOND MARKET. The sell-off in Treasury bonds yesterday foreshadowed a potential disaster of BIBLICAL PROPORTIONS in America: bond yield rose briefly above 5%, which basically meant the Republicans were looking at home mortgage rates potentially at 7 to 7.5% by the midterm elections, which very likely would have resulted in a rout of Republicans in the midterms.

Uh comma space oh!

Investor capital has now moved offshore to Japan and Hong Kong and who knows where else, but it's no longer within the "safe" confines of the United States.

It's almost as if the market decided, individually or together, that the full "faith 'n credit" of the United States of America was no longer guaranteed with a chaotic White House policy dictated by tweets.

Rotadom

Satan's Plaything

- Joined

- Oct 14, 2017

- Posts

- 12,249

You've gone from supporting a felon who defrauded you to supporting him manipulating the market for his own personal gain.Glad I was buying and not selling.

Chumps.

And you're still poor.

Similar threads

- Replies

- 185

- Views

- 6K

- Replies

- 80

- Views

- 2K

- Replies

- 116

- Views

- 4K

Share: