Another day, another decline in all major US exchanges.

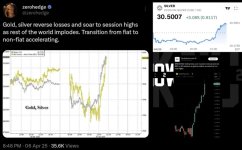

Usually, when money exits the stock market, it enters the bond market. Bond market rates are actually rising though, which indicates investors are NOT investing in US bonds. So WHAR IS INVESTOR MONEY GOING?

Answer: Investors have Yellow Fever! Asian stock markets shooting up! So sorry not sorry!

https://i.imgur.com/MZGG6Un.jpeg

Um, if THAT ^ becomes a long term trend…

We. Told. Them. So.