JohnEngelman

Virgin

- Joined

- Jan 8, 2022

- Posts

- 5,873

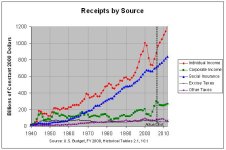

Revenue increases from 1970 to 1980 were the same as from 1980 to 1990Every time we've cut taxes, it's led to revenue increases. The economy grows. Taht broadens the tax base. Also, the lower rates bring more offshored money back into the country.

The problem is spending. Reagan had to deal with a spend-happy Congress controlled by Democrats for most of his term. Unfortunately.

As for family farms, the best way to help them is to stop subsidizing agriculture, ban the Chinese and other hostile entities from owning any farmland (or anything), and reduce the regulatory burdens on them.

During the 1970s the top tax rate was 70%. During the Reagan administration it declined to 28%.

https://www.irs.gov/pub/irs-soi/02inpetr.pdf

During the 1970s the national debt as a percentage of gross domestic product declined from 35% to 32%. During the 1980s the national debt as a percentage of gross domestic product increased from 32% to 54%.

https://www.thebalancemoney.com/national-debt-by-year-compared-to-gdp-and-major-events-3306287

Most of the voters want the government to help us get through life. That is why domestic spending programs are popular.

WASHINGTON (AP)

— As Republican senators consider President Donald Trump’s big bill that could slash federal spending and extend tax cuts, a new survey shows most U.S. adults don’t think the government is overspending on the programs the GOP has focused on cutting, like Medicaid and food stamps.

Americans broadly support increasing or maintaining existing levels of funding for popular safety net programs, including Social Security and Medicare, according to the poll from The Associated Press-NORC Center for Public Affairs Research.

https://apnews.com/article/poll-gov...ial-security-0ccb0538c06d715b43bbbcaa4a1348cf

We want the rich to pay for it.

Pew Research Center, March 19, 2025

Most Americans continue to favor raising taxes on corporations, higher-income households

With Congress considering legislation that would extend the tax cuts passed during the first Trump administration, a majority of Americans continue to say taxes should be increased, not decreased, for large businesses and corporations. They also say this for household income over $400,000 a year...

More than six-in-ten U.S. adults (63%) say tax rates on large businesses and corporations should be raised. This includes 34% who say they should be raised a lot.

https://www.pewresearch.org/short-r...xes-on-corporations-higher-income-households/